What once looked like a bold Frontierland is now starting to become a promising Fantasyland for Walt Disney Co.

Its Shanghai Disney Resort hit 11 million visitors in its first year, company chairman and CEO Bob Iger told Bloomberg's Rachel Chang and Tom Mackenzie last week. That should be a relief to Iger and his shareholders since success for the park, which opened in June last year, was never guaranteed despite all the hype.

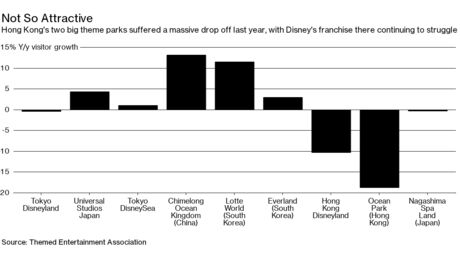

The resort's Hong Kong sibling suffered a 10 percent drop in attendance last year to 6.1 million people, according to the Themed Entertainment Association. But data from the industry group indicate the problem may be less about brand and more about location, considering visitors to Hong Kong's Ocean Park dropped 18.8 percent over the same period.

Some analysts have questioned whether China is building too many theme parks. It's not an unreasonable concern given the sector's boom and bust in the 1990s. A look at Japan, where the economy has been treading water for two decades, should serve as a positive sign both for Disney and Comcast Corp., which expects to open Universal Studios Beijing in 2020.

Tokyo Disneyland, Universal Studios Japan (in Osaka) and Tokyo DisneySea not only remain the top three parks in Asia, but were topped by just two globally last year: Disney's Magic Kingdom in Florida and Disneyland in California. If an aging population and floundering economy can continue to support three huge parks in Japan, then there's reason to believe China's appetite will be larger.

Iger should be happy for another reason. China restricts the number of Hollywood films it allows into the country to just 34 per year and lets the U.S. studios keep just 25 percent of the box office, according to accounting firm PwC. This means that no matter how many hits like it churns out, Disney has to compete for access and distribution in China, and then enjoys only limited upside.

Movies instead will increasingly become a marketing tool for where the real money lies: theme parks and product licensing. Disney already makes more revenue and profit from its parks and resorts than from studio entertainment. Though the studio unit has a better operating margin than theme parks, even fatter profits come from consumer products.

The risk for Disney and Comcast will come from Chinese entrants. Dalian Wanda Group Co. is planning 15 parks by 2020 and Shimao Property Holdings Ltd. wants to open eight by 2019, according to real estate firm Colliers International Group Inc. Wanda in particular, whose billionaire owner Wang Jianlin has jeered at Disney, shouldn't be underestimated: It's now the largest operator of movie theaters globally and also owns Hollywood studio Legendary Entertainment.

This home ground advantage helps the locals, but the Chinese still don't have Mickey Mouse, Buzz Lightyear, Captain Jack Sparrow or Luke Skywalker.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Read more: http://www.bloomberg.com/

The post Disney in China Isn’t Mickey Mouse appeared first on MouseVirals.com - Everything Disney.

source http://www.mousevirals.com/disney-in-china-isnt-mickey-mouse/

No comments:

Post a Comment